If you keep an eye on commercial real estate news, you’ve likely heard about a new tax benefit program called Opportunity Zones. But what are these Opportunity Zones really, and how do they work? We’re here to provide you with information.

First conceived in 2017, Opportunity Zones (OZs) are defined as “economically-distressed communities where new investments, under certain conditions, may be eligible for preferential tax treatment.” They were rolled out under the Tax Cuts and Jobs Act (TCJA). The purpose of the Opportunity Zone program is to encourage private long-term investment of capital gains funds in these zones by providing a tax incentive in qualified businesses and property in these areas. The program has been celebrated for its potential to move billions of dollars into low-income communities

How Does It Work?

Each state nominates low-income zones by census tract, and the nominations are then confirmed by the Secretary of the U.S. Treasury via the IRS. Investors can file an IRS Form 8896 to create a Qualified Opportunity Fund, which can be structured as either a partnership or a corporation, for the purpose of investing in an OZ census track.

Who Benefits?

Real estate developers, REITs, high-net-worth individuals, and wealth management firms are just a few of the potential beneficiaries of the Opportunity Zone program.

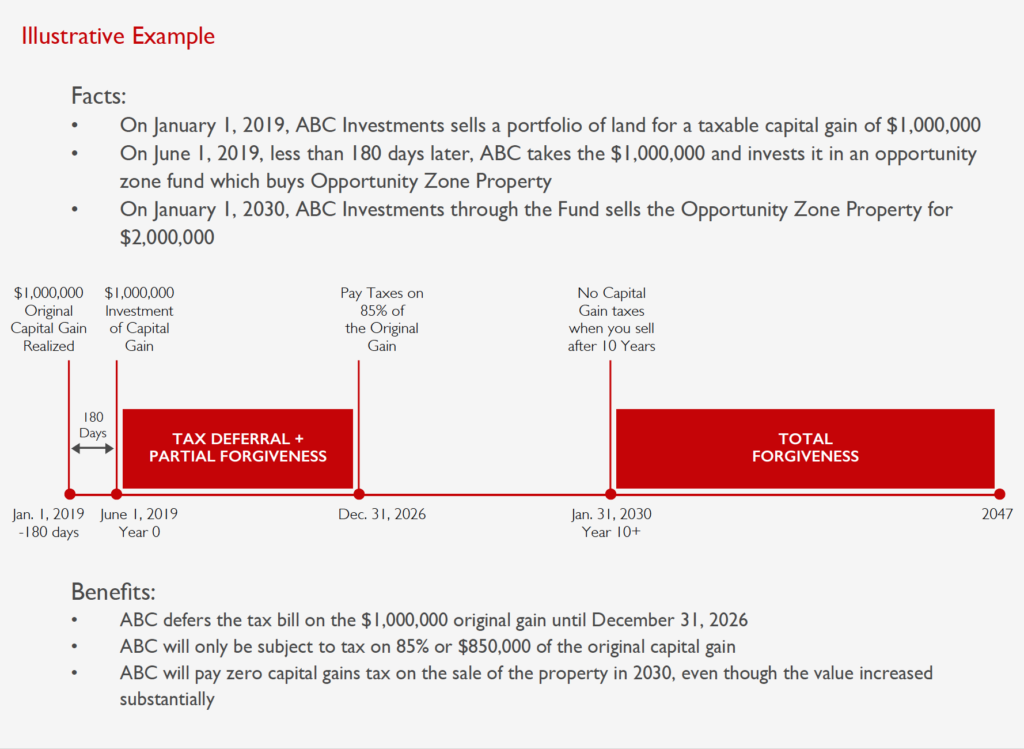

One of the biggest advantages of the OZ program is that it allows investors or developers to defer paying capital gains taxes. In fact, if the gain is placed in a Qualified OZ fund and held for 10 years, that taxpayer can pay zero capital gains on the new investment in that fund—a potential 30-40% increase in the annualized return. The program is appealing to banks and lenders and has also been touted for encouraging new construction.

Where Are Opportunity Zones Located?

OZ plans are now in place for communities in all 50 states.

According to CNN, one in ten Americans now live in one of the zones, which covers 8,700 communities. They include rural, suburban, industrial and downtown areas. Florida has 427 Opportunity Zones, including 70 in Miami-Dade County. View a map here.

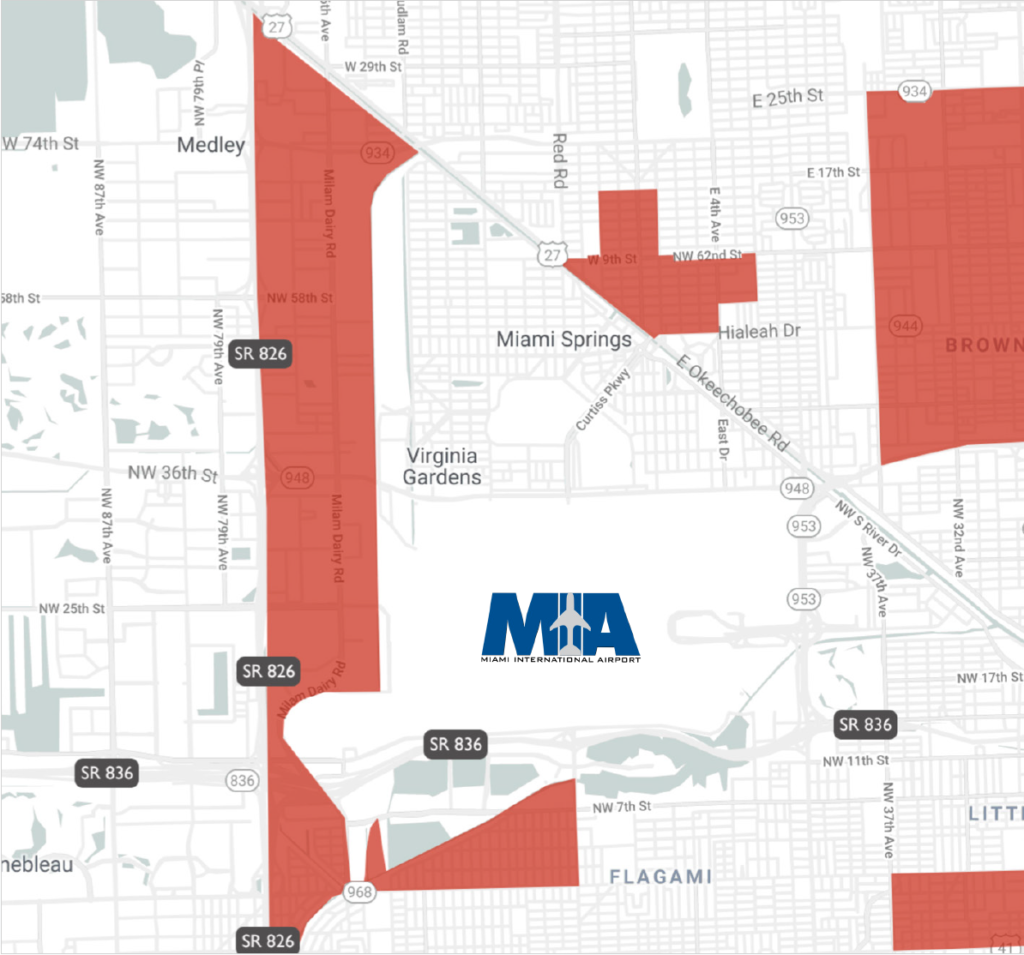

The Airport Palmetto Corridor Opportunity Zone

The Miami Industrial Team at ComReal has identified one of the largest industrial Opportunity Zones in Florida that we call “The Airport Palmetto Corridor.” The Corridor is one of Miami-Dade’s premiere industrial environments, located closer to MIA’s cargo section than any other submarket. Read more here about what makes The Airport Palmetto Corridor so attractive to industrial owners and users.

The Airport Palmetto Corridor Opportunity Zone

Our team at ComReal has the inside knowledge on the industrial opportunity zones in Miami-Dade County and we have organized a team of advisors ready to assist you in taking advantage of these new tax incentives. Contact us for more information.

Opportunity Zone Benefits v. 1031 Exchange

Opportunity zones may be a better option for certain investors than a traditional 1031 exchange because the capital gains funds can come not only from the sale of real estate, but also from a stock liquidation or the sale of business assets or an entire business itself. Additionally, only the gain portion needs to be invested in an opportunity zone, rather than the sum of the original investment in a 1031 exchange scenario.

Additional Details

In order to receive the tax benefits for an investment in an opportunity zone, one must create a new investment vehicle called an “Opportunity Zone Fund” and this fund must invest in “Qualified Opportunity Zone Business Property.” We can connect you with attorneys who can decipher and make sense of this new law and help investors comply with the requirements in order to receive the tax benefits.

There are a few details worth noting here regarding Qualified Opportunity Zone Business Property. To qualify for the tax benefits, the property must, among other things, be acquired by purchase after 2017 and the original use of the property in the zone must either commence with the use of the new entity or the new entity must substantially improve the property.

An entity is treated as substantially improving property if, during any 30-month period, the entity makes capital expenditures with respect to such property at least equal to the property’s acquisition cost, not including the cost of the land. As an example, if an Opportunity Zones deal involved Qualified Opportunity Zone Business Property worth $1,000,000, of which

$600,000 was the value of the land and a $400,000 was the value of the structure, $400,000 of capital expenditures on the building would be required for the investment to qualify for tax benefits of the program.

What Happens Next?

The current government guidelines are very broad so almost any type of project can qualify, but the anticipated “Gold Rush” has yet to begin, as many investors and developers are waiting for more information. Further guidance from the IRS and the U.S. Treasury Department is expected to be released in the coming months, along with greater detail about which projects will qualify. We will continue to keep you updated on new developments.

How Do I Get Started?

Our team at ComReal can help you identify property within Opportunity Zones that are for sale and have re-development potential. We can also point you to our team of experts that can decipher complex terms such as Qualified Opportunity Fund, Qualified Opportunity Zone Property and Qualified Opportunity Zone Business.

Additionally, if you own a property, we can help you determine if it falls within an opportunity zone and the strategies we can use to maximize the value of the property.

Click here to download our complete Opportunity Zone PDF created by ComReal’s Pat McBride. Contact McBride at 305-619-2937 or at pmcbride@comreal.com.

Nothing in this Article should be construed as legal advice or a legal opinion, and readers should not act upon the information contained in this Article without seeking the advice of legal counsel.