INDUSTRIAL MARKET SUMMARY

The Miami industrial market’s Q4 and yearly 2020 vacancy rate was 5% at the close of the quarter with a $12.80 per sq. ft. average (gross) lease rate, up only to $12.82 for the year. Vacancies have risen slightly higher due to the increase in supply of space for lease coming from all the new construction, reaching a seven-year high in Q3 of 2020. Deliveries have totaled 3.4 million sq. ft. over the past 12 months. Increasing vacancies and new construction projects have pulled down rent growth in the region. Industrial real estate, locally and nationally, has been the bright spot in commercial real estate. Overall activity has remained strong with record sale prices and steady lease absorption.

There is over 4 million sq. ft. of new construction in the works, and an additional 3.5 million sq. ft. was delivered over the past year. Though this is well above the metro’s long-term average deliveries, construction starts have slowed in 2020, which will likely lead to a gradual decline in deliveries in coming quarters. Most of what is being built is speculative. Nearly 25% of the market’s entire under-construction pipeline is at Home Depot’s 1 million sq.ft. distribution center in Hialeah in the Outlying Miami Dade Submarket. The largest speculative projects are in the 200,000 – 300,000 SF range such as the two buildings at Gratigny Logistics Center in the North Miami Beach Submarket, which total 447,000 SF and are due to be completed in early 2021.

Vacancy rates in Miami are around 5%, and Industrial vacancies in Miami have recently climbed over the national Index rate for the first time in almost 20 years. Though international trade has been impacted by the pandemic, the e-commerce sector, including Amazon, has been responsible for many of South Florida’s largest lease deals in the past seven months. Amazon signed two large deals in 2020. In April, the company leased about 220,000 SF at the newly built Prologis Beacon Lakes Industrial Distribution Center in the Miami Airport West Submarket. The company also leased a 210,000 SF property in the Hialeah Submarket, which it will occupy following extensive renovations; potentially used as “last mile” facility.

Annual rent has been slowing in the market as the vacancy rates have been rising. Still, at nearly $13/SF, the average rent in Miami is one of the highest in the country and is more than 40% higher than the national average. Within the market, average rents reach as high as nearly $20/SF in the South Central and East Miami Submarkets which are nearest to downtown. These submarkets have had the most trouble maintaining growth and have had some of the lowest rent growth in the market in the past year. Still, at 2% or higher, annual growth in these submarkets has been considerable.

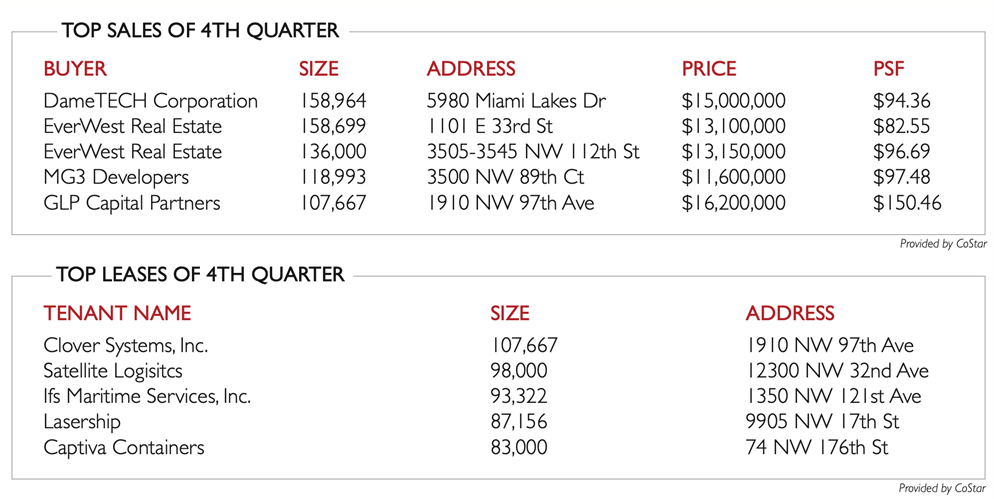

Sales were initially impacted by the CCP virus; however, after the summer, transactions came back strong and demand from users and investors continues. About $900 million traded in the year, a six-year annual low and almost 20% below the 10-year annual average sales volume for the market. A drop off in large national and regional portfolios has contributed to the decline in volume.

Though the region has regained some of its jobs toward the end of the year, as of the Bureau of Labor Statistics’ (BLS) release of November jobs figures, the metro was still down about 64,000 jobs since February. Miami has been a hotspot for the virus, which has impacted the economy, which relies heavily on both domestic and international travel. About half of the 150,000 leisure and hospitality jobs were lost by April of 2020. Though the shape of the economic recovery in Miami is yet to be seen, the good news is that no one industry accounts for more than 15% of Miami’s jobs, helping to insulate the city from higher losses as a proportion of the workforce during downturns. Miami-Dade County will likely grow from a population standpoint as businesses and employees come to the region from other higher-tax areas.

FEATURED LISTING // 12707 Le Jeune Road, Miami, FL

TOTAL AVAILABLE: +/- 10,000 – 81,779 SF

OFFICE: +/- 6,000 SF

LOADING: 32 dock doors equipped with levelers, 1 oversized street level

TRUCK COURT: 165’ non-shared

CLEAR HEIGHT: 17’ – 19’

POWER: Heavy 3-phase

INDUSTRIAL BUILDING IN SUNSHINE STATE INDUSTRIAL PARK SOLD

16215 NW 15th Avenue, Miami, FL

The Industrial Team at ComReal completed the sale of the industrial building located at 16215 NW 15th Ave Miami, FL 33169, inside Sunshine State Industrial Park. This facility is +/- 63,683 SF on +/- 3.15 Acres. The property was used for manufacturing as it offers heavy power and extra parking. The seller, Custom Stainless Steel Equipment, had occupied the warehouse for almost 15 years. The company plans to expand to a larger facility on the West coast of Florida. The buyer, Quantum Equity One, LLC, is a local business owner and investor who may use the facility for his business. The sale price was $6,000,000.

“This building is a good example of the high demand for industrial buildings in Miami. Before we took it to market, we had multiple buyers and offers. The Buyer offered the most flexibility for the Seller so it was the winning contract. It’s important for buyers in this market to be flexible with Sellers,” mentioned Edison Vasquez from ComReal.

This is the fourth transaction the ComReal Industrial Team has completed in 2020 inside Sunshine State Industrial Park. Earlier this year, the team completed two leases at 1120 NW 165th St, bringing the +/- 76,500 SF building to 100% occupancy. Additionally, they completed the sale of 1585 NW 163rd St, a +/- 31,000 SF warehouse on 2.4 Acres for $2,800,000.

For more information contact the Miami Industrial Team at MiamiIndustrialTeam@ComReal.com or 786-433-2380.